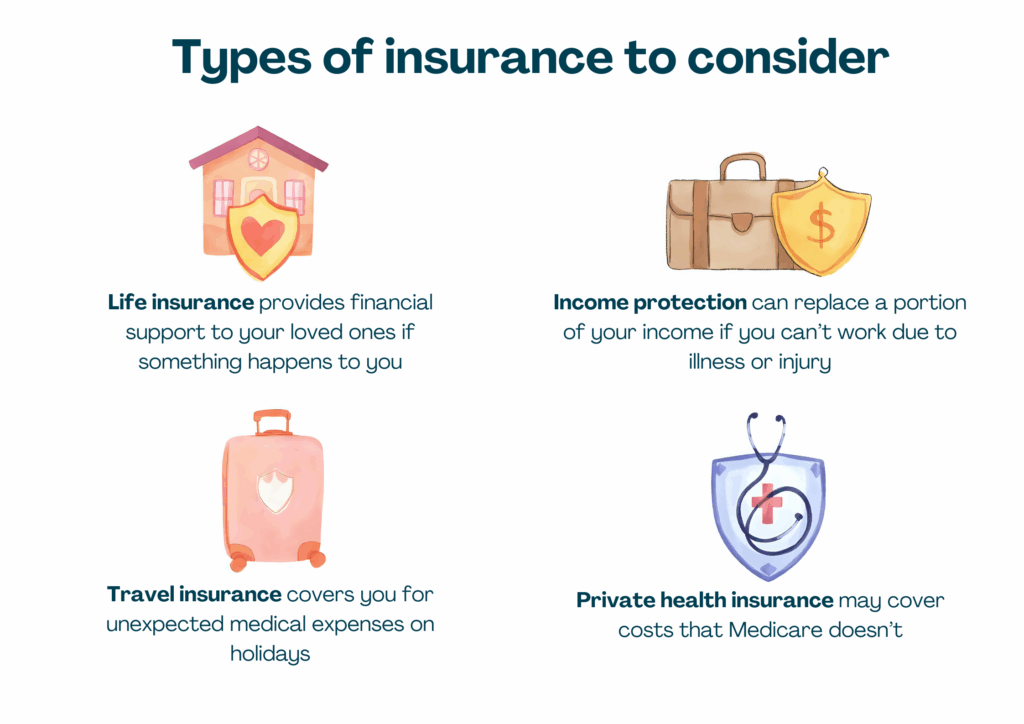

Insurance and Income Protection

Accessing insurance can be harder with CF, but it’s still worth understanding the options available and what to look for. Reach out to the CF community to get advice, often the experience of others in a similar situation can be extremely helpful. You can connect with peers through social media, with support from CFWA, or via your clinical team.

Challenges

There can be some challenges when it comes to accessing insurance, including:

- Some policies may exclude CF or related conditions

- Premiums can be higher compared to people without chronic conditions

What to Check

- Your super fund may already include some cover, such as life insurance or income protection, but it’s not always well advertised. Check the details or ask your fund directly

- Some banks or private insurers offer separate cover. Search your records or call your providers if unsure.

- Speak to a broker who understands chronic conditions like CF and can help you compare options

- Always read the Product Disclosure Statement (PDS) before buying any policy

Questions to Ask

It might be worth asking your insurer or super fund the following questions:

- What does the policy cover and exclude? Are there waiting periods or restrictions for pre-existing conditions like CF and other health conditions (e.g., CF related diabetes)?

- How much will the premium cost now and as I age?

- Is this cover included in my super, or do I need to apply separately?

- What happens to my cover if I change jobs or stop working?

If you’re confused by the fine print, a financial adviser or insurance broker can help you understand the terms.